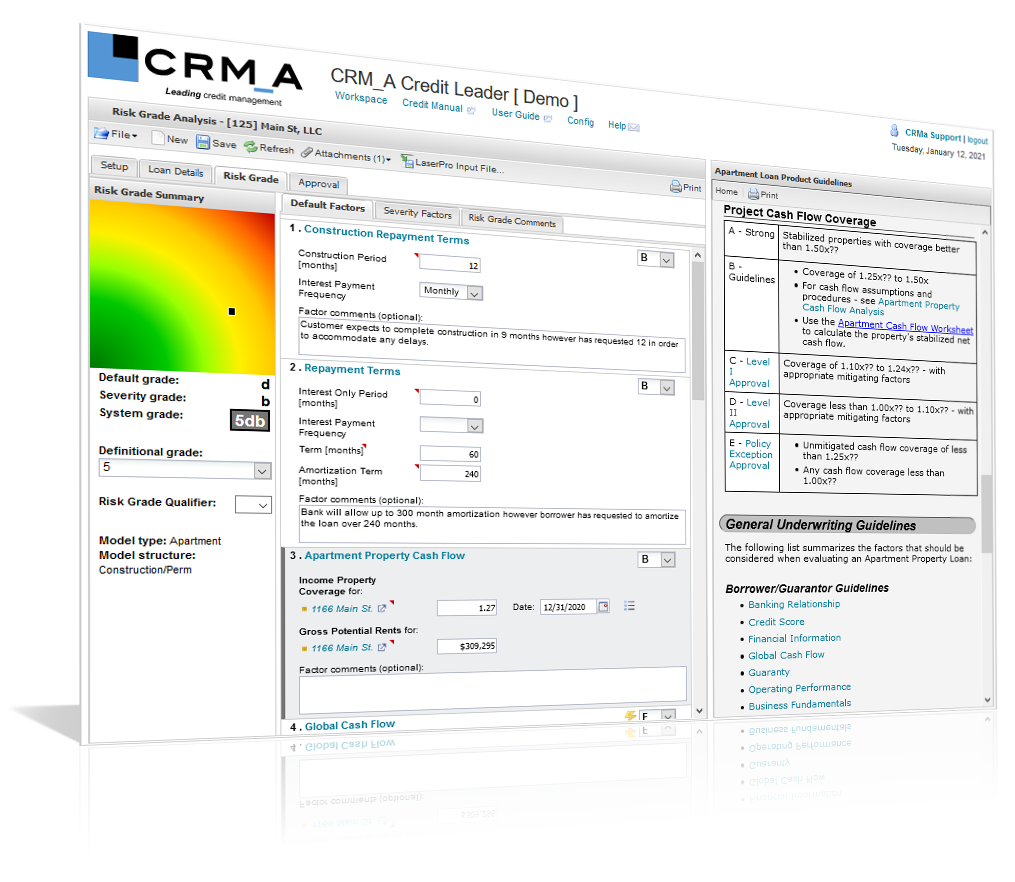

CRM_A Credit Leader is a menu driven underwriting, risk grading, approval, reporting and workflow management system that is seamlessly integrated with the Institution's Credit Manual in a split-screen view. It is designed in an intuitive and user-friendly format and helps promote consistent decision-making during the underwriting, risk grading and loan approval process.

I just wanted to let you know how pleased we are that we made the switch to Credit Leader. It truly has transformed our business and increased our efficiencies. Your staff has been nothing but exceptional to deal with and been very patient.

Peter A. Pequeno, II

SVP & Chief Lending Officer