For decades, lenders relied on their knowledge of borrowers to assess and predict loan performance. But as expectations have evolved, so have adaptive innovations. The most forward thinking banks and credit unions are now taking an ROI approach to loan and risk management. That means investing in independent assessments, strengthening internal review capabilities, and in many cases doing both. These organizations recognize that top-rate, credit-risk expertise is critical to not only compliance, but to generating positive net returns.

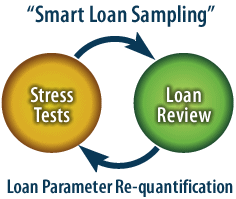

CRM_A delivers a rigorous and objective assessment of your loan portfolio. Alternatively, we complement your internal review practice with best-in-market sampling expertise.

Our loan reviews are more than a regulatory check-the-box exercise. We create value through deeper insight into potential risks.

The result: