About CRM_A

Market tested; Market proven.

CRM_A has a proven track record of advising community and regional financial institutions on loan and portfolio risk management practices. CRM_A's predecessor Credit Risk Management was formed in 1989 with a focus on comprehensive Loan Policy, Loan Review and Due Diligence. Since then, we have innovated and leveraged that experience into superior technology solutions spanning Underwriting and Risk Grading, Cash Flow Analysis, Loan Pricing, Portfolio Stress Testing, and ALLL Estimates. CRM_A evolved to focus on these core competencies and expanded our business model to remain two steps ahead of the marketplace.

Today, CRM_A helps community and regional financial institutions, nationwide, improve bottom-line results by delivering best-in-market portfolio loan review and due diligence, quantitative analytics, stress testing, training, and underwriting software solutions. CRM_A stands alone in offering both advanced, cloud-based technology and a full range of complimentary services in the management of credit systems focused on the unique structure and needs of community and regional financial institutions. The company gives the segment a customer-focused means of meeting both management and regulatory demands without the frustration and cost of engaging multiple, disconnected and inwardly focused providers of “parts” of managing the Credit Lifecycle.

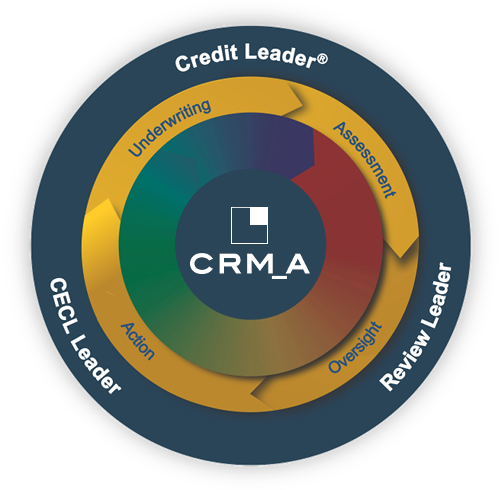

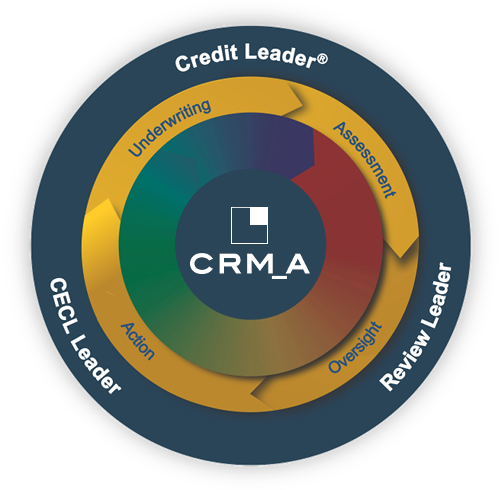

CRM_A is an is organized along three closely interdependent disciplines: Underwriting, Review and Analytics. The products we offer our customers have been built by credit and modeling experts with experience in managing and implementing technology, rather than by technology experts with limited banking and/or credit experience.

Purpose, Mission, Vision and Values

Our Purpose

The health of the U.S. financial system is dependent on the diversification of risk provided by community lending, which provides a naturally anti-fragile structure to our economy that big banking instead concentrates. CRM_A is dedicated to the continuous improvement of the competitive position of community lenders through improved efficiencies.

Our Mission

Integrate technology and services — address credit management as a single system rather than just its component parts.

Reduce costs, reduce complexity — merge institution-specific underwriting manuals with software, communicate with core systems across credit disciplines.

Improve processes, analytics, and tools — create new tools and systems to ease, automate and assist with comprehensive credit management.

Our Vision

To go beyond providing services, technology, models and setup. To be Essential: CRM_A's vision is to be a critical component of our clients' credit management systems.

Our Values

- Integrity

- Reliability

- Creativity

- Empathy

- Unselfishness

- Alacrity

- Energy

Customer Service

Our service model is hands-on with a high touch. We combine best-in-class products and services with rigorous consultation, training and anytime-anywhere support. Whatever the need, we promise unwavering client focus and unequalled service delivery. That’s how we win converts and build long-term relationships. But don’t take our word — we’re biased. Our clients’ words and actions speak for themselves.

CRM_A’s Concentration Analysis product has allowed us to take our Concentration Management process to a whole new level. This product allows us to look at our concentrations on a granular level and a portfolio wide level. The Dashboard feature puts all of our numbers into a format that is easy to understand. Our bank really likes the mapping function that allows us to see our concentrations from a geographic perspective. CRM_A’s product has helped us to exponentially increase our knowledge of the concentrations within our loan portfolio. It will help us ‘write our story’ for bank regulators and for investors who have questions about concentrations and how they impact our bank's overall credit risk. I would recommend this product for any bank that needs to better understand Concentration Risk in their loan portfolio.

Ion Mixon

EVP CRO

The First, A National Banking Association

I just wanted to let you know how pleased we are that we made the switch to Credit Leader. It truly has transformed our business and increased our efficiencies. Your staff has been nothing but exceptional to deal with and been very patient.

Peter A. Pequeno, II

SVP & Chief Lending Officer

Surrey Bank & Trust

We have enjoyed a relationship with CRM_A for more than 10 years now. They continue to provide exceptional customer service and offer a wide array of products and services that help us protect and improve the quality of our assets. Our lending staff and our regulators accept and appreciate the transparency enabled by CRM_A’s product line of credit underwriting tools.

Shannon S. O'Donnell

Senior Vice President

Credit Administration

AuburnBank

Auburn, Alabama