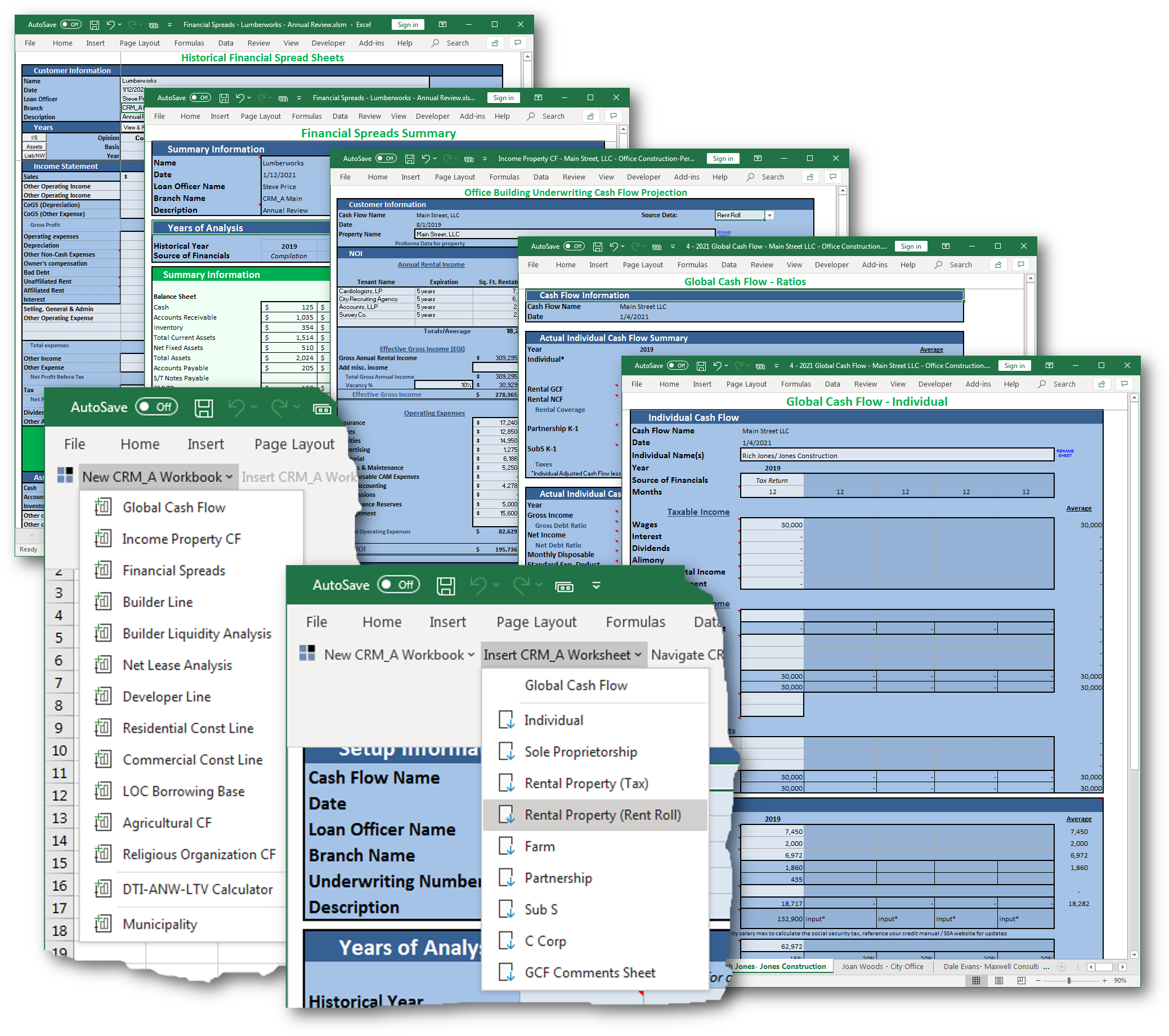

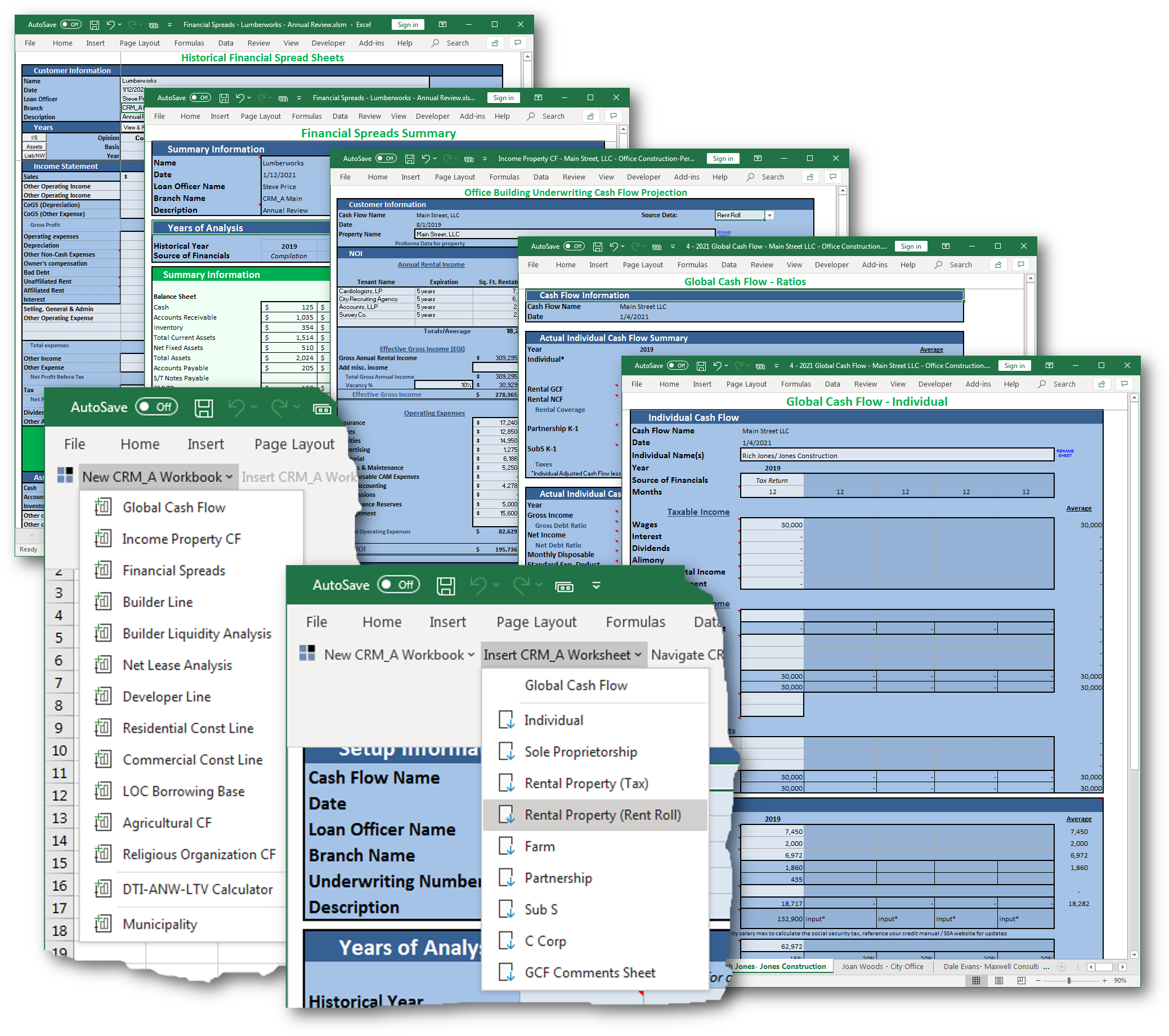

CRM_A Toolbar®

Used by banks and credit unions across the country, the CRM_A Toolbar® provides a wealth of highly standardized cash flow and project analysis tools designed to establish consistency and streamline the underwriting process.

- Global Cash Flow: Analyze cash flows and determine the repayment capacity of borrowers, guarantors and/or interrelated third parties.

- Income Property Cash Flow: Analyze cash flow probabilities, supportable loan amount scenarios and complete sensitivity analyses for income-producing properties.

- Financial Spreads and Projections: Perform detailed analysis of business financials including multi-year historical, interim and projected ratio analysis, transactional stress testing and breakeven analysis.

- Borrowing Base Line of Credit: Manage borrowing base lines of credit based upon eligible collateral and approved advance rates.

- Builder Line of Credit: Manage residential construction projects including established line limits and utilization, sales and lot release data and average inventory days.

- Builder Liquidity Analysis: Determine the appropriate volume of speculative homes that a builder should be permitted to build based upon cash on hand, average sales price, gross profit margin and various financial statement metrics.

- Developer Line of Credit: Manage commercial and residential development projects including project economics, sellout projections, draws, releases and sales tracking.

- Commercial Construction Line: Manage commercial construction projects including project budget, equity requirements, build-out and draws.

- Residential Line of Credit: Manage residential construction projects including inspections, disbursements, percentage of completion and differences in expected and actual advances.

- Net Lease Analysis: Detailed analysis tool for complex retail and office properties including forward projections and stress scenarios.

- Religious Organization Cash Flow: Complete project analysis based upon capital campaigns, balance sheet characteristics and historical, proposed and projected year-over-year debt service analysis.

- Municipality / Non-Profit: Complete borrower analysis based upon various established revenue streams and expenditures, balance sheet recap and year-over-year ratio and benchmark analysis.

- Agriculture Cash Flow: Borrower and operational analysis for beef, crop, dairy, poultry and swine operations.

- Debt-to-Income, Adjusted Net Worth and Loan-to-Value: Detailed calculations to determine Debt-to-Income, Adjusted Net Worth and Loan-to-Value for individuals.