Our Portfolio Stress Testing service utilizes our proprietary Credit Risk Migration Analysis tool to leverage your institution's historical data and efficiently identify your potential credit losses under stress. Going beyond a simple regulatory checkmark, our approach provides true insight into your "pockets of risk" and provides you with the quantitative knowledge to plan for the unexpected. We provide our stress-test results in a concise, graphical format, so you can focus on outcomes rather than drown in data. Of course, underlying data is always available for additional analysis.

CRM_A's stress testing solution is integrated with Allowance Leader. By using consistent impairment and migration inputs, the Bank can produce stress testing results that are actionable and realistic regardless of whatever challenges the Bank currently faces.

CRM_A responds rapidly and professionally to changing circumstances. We developed a whole new approach to stress testing and loss forecasting as part of the 2006 financial crisis. And once again, when COVID struck, we developed new methods for projecting losses during a pandemic. These were not simply “burn down” or “worst case” scenarios. These were realistic scenarios with understandable assumptions that could be articulated to an Institution’s board of directors or regulators.

When the next crisis strikes, do you want to be using the stress tests from the last crisis? Or do you want to be partnered with a firm ready to meet whatever new challenge arises?

Not a "black box" solution. We combine bank and credit union expertise with best-in-class modeling. The result is practical analytics insight sized for your institution.

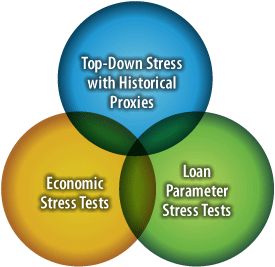

CRM_A Quickly adapts efficient and scalable solutions using readily available data. We can run unique tests both discretely and together for triangulation and cross-validation.

We have worked with CRM_A for five years on stress tests and have found their work to be invaluable. We particularly appreciated their flexibility to change course in the middle of the pandemic to give us the most timely inputs for critical decisions we had to make in an uncertain time. Their analysis is unsurpassed and their ability to explain to constituencies of varied knowledge is outstanding!

CCO, $3B Commercial Bank