See what you've been missing, what you didn't know: Call 919-573-0247 and get your CRM_A loan review quote today

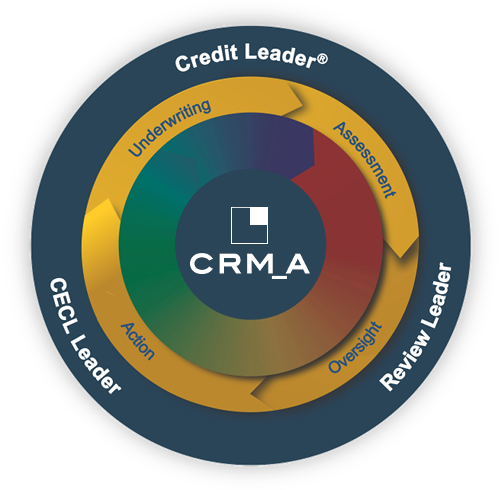

CRM_A is the proven industry-best integrator of credit risk expertise, quantitative analysis, and technology. We have over 30 years of success serving lenders across the United States with rigorous loan reviews and due diligences. CRM_A provides a wide range of underwriting, risk grading, and analytical products and services. Our full-spectrum capability is unmatched in providing a truly complete view of risk, from individual loans, to aggregate portfolios and the total enterprise environment. This sets us apart in our ability to assist in identifying credit-risk objectives, optimizing management, and increasing our clients' profitability.